A closer look at the rise of the independents

In News

Follow this topic

Bookmark

Record learning outcomes

Are independents and small community pharmacy groups onto something when they snap up new additions to their estates, or are they simply taking on a poisoned chalice? By Sasa Jankovic

Lloydspharmacy’s belt and braces exit from the high street by the end of November last year, and a scaling down of operations by Boots, has paved the way for independents and small groups to expand their estates and take on a growing share of the prescription market.

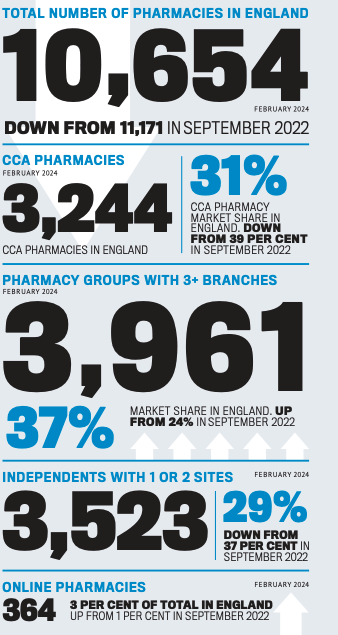

The recent Sigma conference in South Africa hosted many conversations about the rise of independents in terms of dispensing market share, services and overall pharmacy numbers. AIMp chief executive Leyla Hannbeck says independent multiples are now “dominating the sector”, and data presented by analysts RWA Pharmacy at the conference showed that of the 10,654 pharmacies in England in February 2024, 3,961 were groups with three or more branches, making 37 per cent of the total (up from 24 per cent in September 2022); independents with one or two sites made up 3,523 pharmacies, 29 per cent of the total (down from 37 per cent in 2022).

Despite the potential to grow by acquisition, there remains the very real spectre of diminishing dispensing margins turning what might have appeared to be a profitable acquisition into a poisoned chalice.

We’ve recently seen the UK’s biggest distance dispenser Pharmacy2U post losses of £5.6 million, according to its latest accounts for 2022-23, despite slashing distribution costs by £8m and wage costs by half a million, at the same time as increasing market share and revenue.

If the biggest player in the market can’t make dispensing NHS prescriptions turn a profit then surely this and other business pressures are bound to be more keenly felt in independents. And of course ongoing workforce pressures and rising general business costs are impacting the sector as a whole.

Disappearing margins

On the plus side, the bonus for independents over large multiples in this market is their agility. “Independents are much quicker to react and it’s much easier for them to put new things in place like Pharmacy First and take on new opportunities,” says Lindsey Fairbrother, owner, superintendent pharmacist and independent prescriber at Good Life Pharmacy in Hatton, Derbyshire. “But on the other hand, people are working harder than ever before chasing every pound and trying to balance dispensing with service income, while Category A changes can only make things worse as you can’t predict if you’ll be reimbursed and what your cash flow will be.”

Pharmacy First lifeline

The launch of Pharmacy First in England has been heralded as a way out of this – with an impressive 3,000 consultations carried out in the first three days of the service. But contractors have already noted that while the additional consultation income is welcome, it is not yet enough to pay for additional staff members, so continuing workforce pressures remain.

“If you can get the volume through it’s great, but then you’ve got more workload,” says Burdon. “To make it really fly, you need GPs on board, and their receptionists are already immensely busy. Plus another problem with Pharmacy First is that it’s very narrow, so it’s a good ‘toe in the water’ for those starting out offering services, but if you are already willing and able, it’s frustrating you can’t do more with it.”

Jonathan Burton, community pharmacist and director of the growing chain of Right Medicine pharmacies in the central belt of Scotland, was involved in the development of Pharmacy First in Scotland in 2020, as well as early iterations of its independent prescriber component Pharmacy First Plus. He has followed its launch in England.

“This first point of contact role for us needs to be formalised in the NHS, and Pharmacy First is the start of that,” he says. “But I do think it is tough to nurture these developing services when you are in an environment that is quite financially challenging, and that’s a shame as it is a great opportunity for the profession. The key is to take it at a pace which matches your business model rather than doing everything all at once.”

Further pressures

In the meantime, there are plenty of other business pressures that are more keenly felt by independents and small groups than they are by chains. “We desperately need Designated Prescribing Practitioners (DPPs),” says Burton. “I DPP four people at the moment and I need to support more. Even in 2026, when new entrants to the profession will qualify with an IP annotation in place, the need will ramp up again as they will still require a level of supervision in some context as it will take years to develop their practice – as it does for all healthcare professionals.

“We have lots of education and training pharmacists working in CPPE and the NHS for Scotland, so how do we team up more effectively as we will all need to take a bit of this on?”

For Fairbrother, it’s a shift in perception that is needed. “We are not destination shops any more for things like toiletries, so we can only survive through sales of medication,” she says. “Dispensing is still the foundation stone of the contract, no matter what anybody says – even though the new pharmacy minister seems to suggest we should just do extra private services and counter sales to mitigate losses on the dispensing side.”

As a result, Fairbrother believes the “old fashioned job” of chasing best prices is back. “People are watching the cost of everything they are doing – potentially sometimes in unsafe ways such as running on bare bones in terms of staffing, which will only get worse in April with wage costs rising, alongside the cost rises of fuel and medicines, with no definite income in return.

“Lots of people have put their heart and soul into buying a pharmacy, but it’s a dangerous time to invest, and those who have won’t see the fallout for a couple of years until they see if they are making money or making a loss.”

At the other end of the scale are older contractors who have been working in the sector for a long time, but who are now working harder than ever for less money. “They are thinking ‘I can’t keep working harder but being paid less than I was when I was 20’, so we are probably going to see more people wanting to retire in their 60s – a lot earlier than they planned – and then what happens to their pharmacy?” she says. “There used to be security in pharmacy, but there’s not any more, with the knock-on effect that banks used to be happy to lend people money to buy a pharmacy but lots won’t now as they realise there are no guarantees of a return.”

Burdon agrees, saying: “Pharmacy is not an attractive proposition for anyone right now and I’d counsel anyone against running in and buying up pharmacies at the moment. There’s the worry that people are having to dip into savings to prop their business up.”

While multiples are in the enviable position that they can close branches if they need to, Burdon says: “Independents can’t. Although everyone is struggling – the multiples, DSPs, and medium sized chains – to point the finger at just the multiples for closing is unfair because they are not doing anything anyone else wouldn’t do if they could.”

The solution, Burdon says, would be “to be properly rewarded for the new services we provide”, but he admits: “What that looks like I don’t know. It’s a primary care problem, not just a problem involving pharmacy, and the issue is to decide where the capacity is and who does what. The whole thing must be examined in the round. But we’ve got to remain upbeat – we are in it now.”